Validator Overview

Nearly all of the ETH deposited into the Dinero protocol is staked on the Ethereum network by validators. At first the validators will be primarily operated by Dinero protocol itself, however, in the future it will be possible for outside parties to operate validators. The validators will be used to secure the Ethereum network and also operate the Redacted Relayer RPC once enough ETH is staked to allow for consistent successful block proposals. Validators are spun up when the pending deposits are larger than the deposit size of 32 ETH plus the buffer.

Reward Distribution

Our secure keepers come with the node infrastructure to maintain the upkeep of the system and continuously distribute rewards (Execution Layer, Consensus Layer, MEV rewards) to apxVault.

Consensus Layer Rewards

In Ethereum, at least 66% of nodes agree on the global state of the network. Consensus layer provides incentives for participating in proposing or validating blocks, voting for their view of head of chain and participating in sync committees.

- Block proposal reward - Rewards for proposing blocks as well whistleblowing rewards for providing evidence of dishonest validators.

- Attestation Reward - Every epoch or 6.4 minutes, a validator proposes an attestation to the network. The voting from all the validators are compiled to reach consensus regarding the state of Ethereum blockchain. Validators vote for a source checkpoint for Casper FFG, target checkpoint for Casper FFG and chain head block for LMD-GHOST.

- Sync committee reward - Sync committee is a group of 512 validators. Every 27 hours or 256 epochs, 512 validators are randomly assigned by the Ethereum network to a sync committee. The committee continually signs block header. Validators in the sync committee can get significantly more rewards by serving light clients. Purpose of this committee is to allow light clients to verify block i.e. authenticate block signature without need to connect to an external provider.

Execution Layer Rewards

Execution layer rewards are available to validators for validating a block (group of transactions). These rewards are paid directly to the Pirex ETH validator contract.

- Transaction priority tips - Transaction priority tips are associated with each transaction where the sender would include them to incentivize Dinero validators for processing transactions faster.

- MEV tips - Dinero node comes with MEV-boost enabled. MEV searchers might tip the Dinero validators for processing bundles of transactions quickly.

apxETH

The pxETH token itself does not receive any rewards. However, pxETH can be deposited into an auto compounding rewards vault in exchange for apxETH, a ERC-4626 vault share token. This vault benefits from validator rewards (minus fees), which are compounded into pxETH. As rewards are earned by the vault over time, the amount of pxETH underlying each apxETH increases. apxETH is fungible and composable within DeFi and can be used as collateral for DINERO stablecoin loans.

The Redacted DAO will incentivize DEX pxETH liquidity using its treasury and BTRFLY emissions. DEX’s with good levels of bribe efficiency will be targeted, so as to make best use of these assets, boost yields on LP positions, and increase pxETH TVL. With not all pxETH being deposited in the rewards vault (some being in liquidity positions), this scenario creates a leverage effect on the rewards, with 1 pxETH in the rewards vault linked to rewards from more than 1 ETH staked within the Dinero protocol.

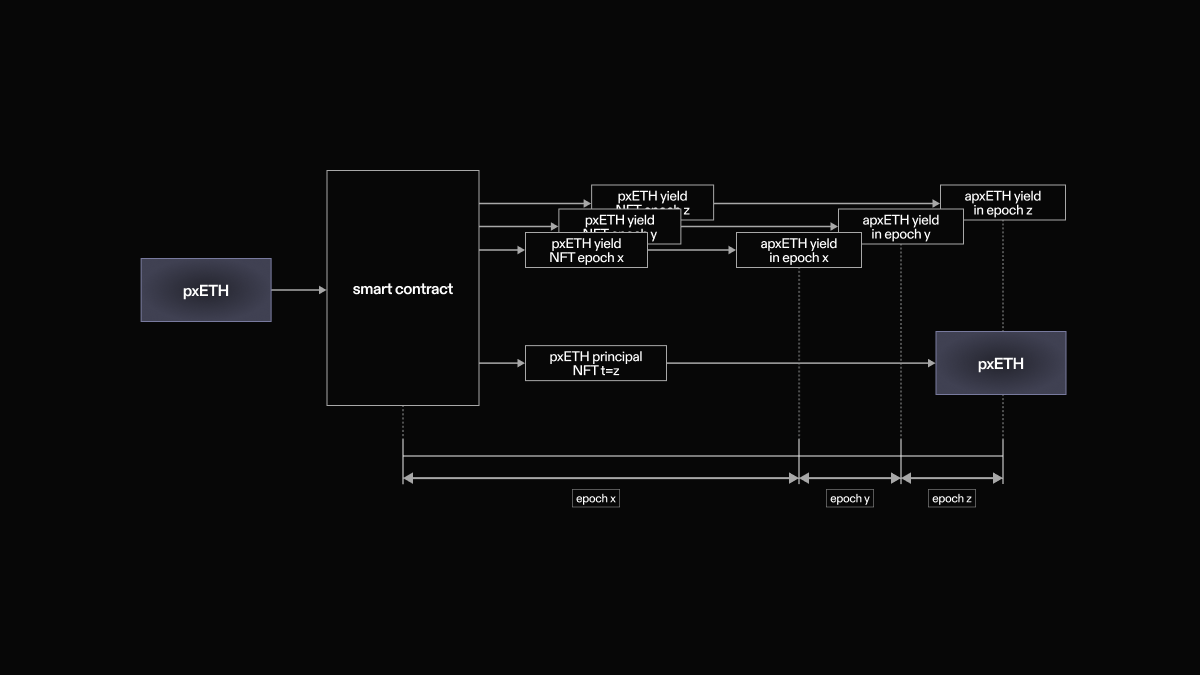

Yield Stripping

Yield from the apxETH vault can be tokenized through yield stripping. When yield stripping, users exchange their pxETH in exchange for ERC-1155 NFTs representing future pxETH and future rewards earned by pxETH in the rewards vault. Users have the ability to choose how many rewards periods they wish to tokenize. These yield and principal NFTs are semi fungible, are composable within DeFi and can be traded (e.g. on the Pirex Marketplace).

The tokenization of future pxETH and future returns provides users the ability to leverage, hedge, and speculate on pxETH and future returns. The trading of future yield and future pxETH could be a large market, especially considering the various liquidity mechanisms available to pxETH which are designed to keep the pxETH:ETH peg tight, therefore providing access to the futures market of the second largest crypto asset, ETH.